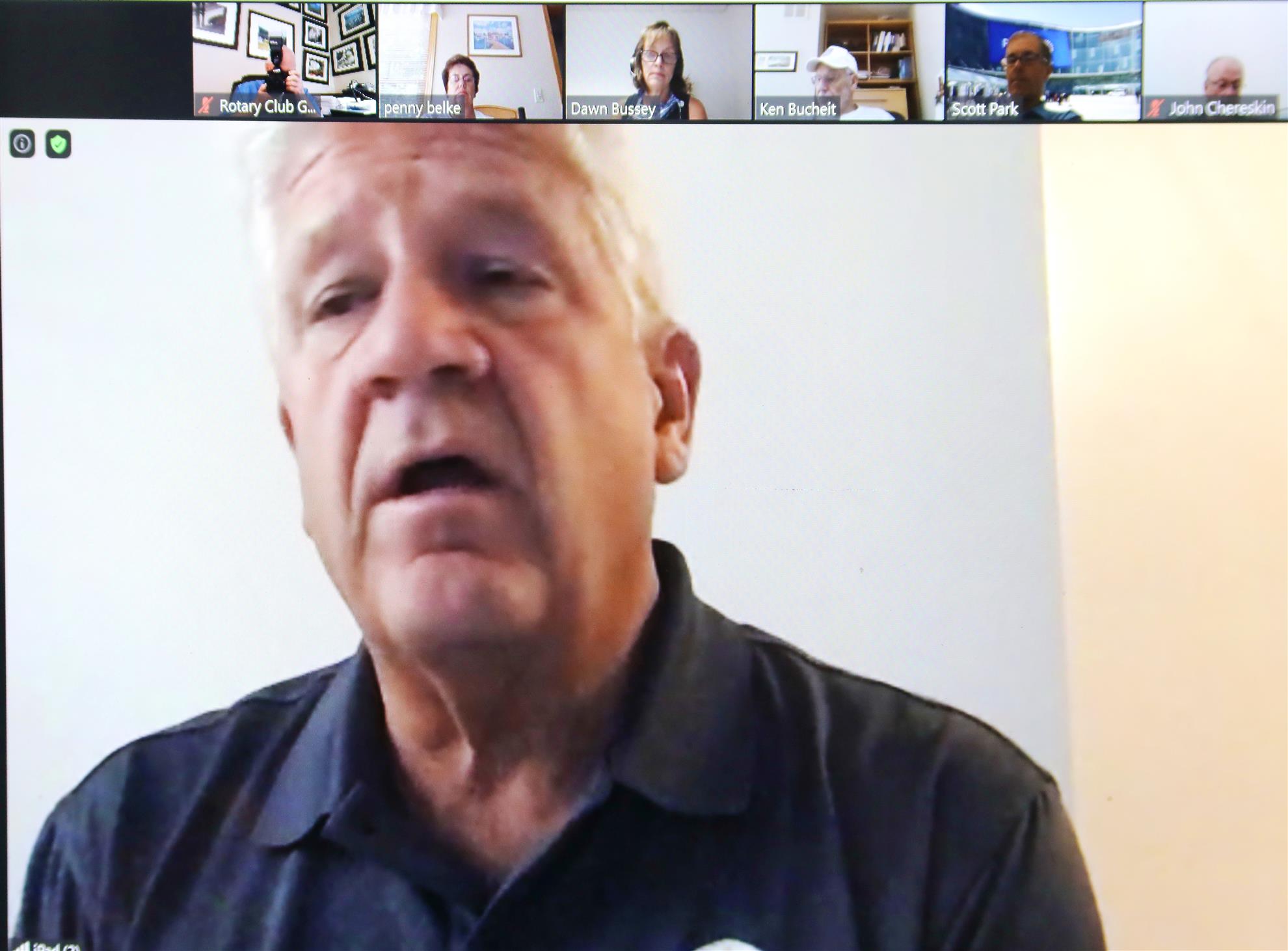

Invest in Kids Act- Illinois Tax Credit Scholarship Program....Edward F. Burjek: CPWA®, CFP®, CRPC®

Senior Vice President - Wealth Management

Wealth Management Advisor

A program worth looking at if you have children or grandchildren that will some day go to college....PJ

ABOUT THE TAX CREDIT SCHOLARSHIP PROGRAM INVEST IN KIDS ACT.

DESIGNATING DONATIONS.

DONATION PROCESS.

SCHOLARSHIP ELIGIBILITY.

TAX CREDIT SCHOLARSHIPS.

EMPOWER ILLINOIS.

TAX CREDITS.

Illinois enacted the Invest In Kids Scholarship Tax Credit Program in 2017. This program offers a 75 percent

income tax credit to individuals and businesses that contribute to qualified Scholarship Granting Organizations

(SGOs). The SGOs then provide scholarships for students whose families meet the income requirements to attend qualified, non-public schools in Illinois.

income tax credit to individuals and businesses that contribute to qualified Scholarship Granting Organizations

(SGOs). The SGOs then provide scholarships for students whose families meet the income requirements to attend qualified, non-public schools in Illinois.

Individuals may direct their donations to a particular school or subset of schools, but not to an individual student or group of

students. Corporate donors cannot designate their donations to a particular school.

students. Corporate donors cannot designate their donations to a particular school.

Donors can begin the process by registering with mytax.illinois.gov. After the registration process, which can take up to

10 business days, donors will be ready to reserve their tax credit on a first-come, first served basis. When reserving their

tax credit, donors should select Empower Illinois as the Scholarship Granting Organization. Once their credit has been reserved,

they have 60 days to make their donation to an SGO.

10 business days, donors will be ready to reserve their tax credit on a first-come, first served basis. When reserving their

tax credit, donors should select Empower Illinois as the Scholarship Granting Organization. Once their credit has been reserved,

they have 60 days to make their donation to an SGO.

To be considered for a 2018-2019 scholarship, K-12 students must come from a household with income below 300 percent of the federal poverty level ($73,800 for family of four). Prior to

April 1, priority will be given to:

• Students from households below 185 percent of the federal poverty level ($45,510 for family of four)

• Students who reside in a “focus district” (low-performing public schools)

The Tax Credit Scholarship will cover up to 100% of private school tuition up to a maximum of the average Illinois cost to

educate which is roughly $13,000.

• Students from households below 185 percent of the federal poverty level ($45,510 for family of four)

• Students who reside in a “focus district” (low-performing public schools)

The Tax Credit Scholarship will cover up to 100% of private school tuition up to a maximum of the average Illinois cost to

educate which is roughly $13,000.

Students with unique learning needs, including those who are gifted, English language learners, or those with special

education qualifications, will receive larger scholarships — up to double— roughly $26,000. Key information about the

program and donating to these scholarships can be found on the web site.

As usual as a thank you for speaking to our club our resident Library Director presented our speaker with a book tabled in his honour to be placed in the Glen Ellyn Public library.